BTC Price Prediction: Consolidation Before Next Leg Up as Adoption Accelerates

#BTC

- Technical Outlook: BTC consolidating near key moving average with bullish MACD divergence

- Market Sentiment: Extremely positive due to institutional adoption milestones

- Risk/Reward: Favorable with clear support at $112.7k and upside to $120.8k

BTC Price Prediction

BTC Technical Analysis: Short-Term Consolidation Likely Before Next Move

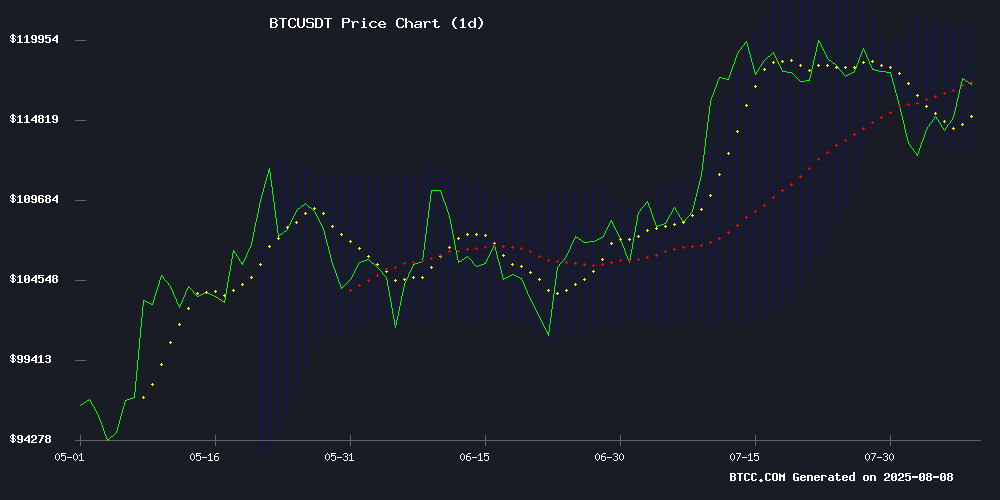

BTC is currently trading at $116,620, slightly below its 20-day moving average of $116,729. The MACD shows bullish momentum with the histogram at 975.26, though the price is testing the middle Bollinger Band at $116,729. According to BTCC financial analyst Robert, 'The technical setup suggests a period of consolidation between $112,693 (lower Bollinger) and $120,765 (upper Bollinger) before the next decisive move.'

Bullish Catalysts Accumulate as Institutional Demand Grows

Wall Street's accelerating Bitcoin purchases, regulatory tailwinds from Trump's 401(k) order, and El Salvador's banking innovations are creating perfect storm conditions. 'The supply crunch from institutional accumulation aligns with our technical view of limited downside,' says BTCC's Robert. Notable developments include Block's 108 BTC treasury addition and VP Vance's prediction of 100M US Bitcoin holders.

Factors Influencing BTC's Price

Wall Street’s Bitcoin Buying Spree Triggers Severe Supply Crunch

Institutional investors are accelerating their Bitcoin acquisitions, creating a supply-demand imbalance that could drive prices higher. Year-to-date, institutions have purchased 545,000 BTC—5.6 times the new supply mined during the same period. The fixed cap of 21 million BTC intensifies scarcity dynamics.

BlackRock and MicroStrategy lead the institutional charge, signaling strong conviction in Bitcoin’s long-term value proposition. "There’s not enough Bitcoin for everyone," warns JAN3 CEO Samson Mow. Analysts suggest the supply shock may already be underway, with dwindling exchange reserves compounding the pressure.

Crypto Markets Rally as Trump's 401(k) Order Opens Door to Digital Assets

Crypto markets surged over the past 24 hours, with the CoinDesk 20 index climbing 5.3% as regulatory clarity and new U.S. policy measures bolstered risk appetite. Bitcoin edged up 1.3% to $116,500, while broader gains followed President Trump's executive order expanding 401(k) investment options to include cryptocurrencies.

The directive tasks the Department of Labor and SEC with drafting new guidance for retirement accounts—a move analysts say could funnel trillions into digital assets. "This unlocks $8.7 trillion in retirement capital for bitcoin and crypto exposure," said CoinShares' James Butterfill. Wintermute trader Jake Ostrovskis noted that even modest allocations would dwarf existing ETF inflows, creating structural demand from long-term investors.

Block Expands Bitcoin Treasury by 108 BTC Amid Market Volatility

Jack Dorsey's Block has fortified its Bitcoin reserves with an additional 108 BTC in Q2 2025, elevating its total holdings to 8,692 BTC—a $1 billion bet on the cryptocurrency's long-term viability. The acquisition comes despite a $212 million paper loss from Bitcoin's price decline, underscoring the company's conviction in its crypto strategy.

Block's gross profit surged 14% to $2.54 billion during the quarter, demonstrating how traditional financial performance and digital asset accumulation can coexist. Dorsey's vision of Bitcoin as foundational infrastructure for the digital economy grows increasingly tangible as the firm cements its position among corporate crypto custodians.

El Salvador Announces Plans for Bitcoin-Only Banks to Boost Financial Inclusion

El Salvador is pioneering the world's first Bitcoin-exclusive banking system, further cementing its position as a cryptocurrency innovator. The National Bitcoin Office (ONBTC) revealed plans for specialized financial institutions that will primarily handle Bitcoin transactions, though operational details remain undisclosed.

This initiative directly addresses the country's banking gap, where 70% of citizens lack traditional financial access. The proposal builds on President Nayib Bukele's earlier Bank for Private Investment framework, which reduces regulatory barriers for institutions holding at least $50 million in capital. These banks would enjoy streamlined international partnerships and expanded lending capabilities while being permitted to register as Bitcoin service providers.

The move comes as El Salvador's Bitcoin reserves reach $747 million, bolstered by its comprehensive crypto adoption strategy since 2021. The nation has already implemented the Chivo wallet, launched Bitcoin bonds, and developed geothermal-powered mining operations.

While proponents like Max Keiser and Cathie Wood champion the economic potential, the IMF maintains concerns about volatility and consumer risks. The banking proposal marks another bold step in El Salvador's cryptocurrency experiment, potentially creating a blueprint for other nations.

El Salvador Proposes Bitcoin-Only Bank in Bold Crypto Push

El Salvador doubles down on its Bitcoin bet with a radical banking proposal. The government plans to establish a financial institution operating exclusively in BTC, eliminating fiat conversions entirely. This follows the country's 2021 move to adopt Bitcoin as legal tender.

The proposed bank would handle deposits, loans, and transfers solely in cryptocurrency. Officials claim this model will reduce transaction costs while increasing transparency and processing speed. The initiative aims to attract crypto-focused businesses and investors to the Central American nation.

Market observers note this represents the most comprehensive state-led cryptocurrency integration attempt to date. The move could pressure other developing nations to accelerate their own crypto adoption strategies as digital assets gain institutional credibility.

Bitcoin Defies Market Fears with Resilient Performance

Bitcoin (BTC) has demonstrated remarkable resilience despite renewed liquidity concerns and miner sell-offs on Binance. The cryptocurrency's price held steady at $116,707, buoyed by a 7.4% increase in mining difficulty—a sign of network stability. Bulls are now eyeing a return to the all-time high seen on July 14, as miner capitulation fears subside.

On July 25, miners moved 18,000 BTC (worth over $2 billion) to Binance, coinciding with a $650 million USDC outflow. While this initially sparked concerns, Bitcoin's price action remained subdued compared to past corrections. Analysts note that miner behavior, though not panic-driven, isn't fueling upward momentum either.

The market's liquidity shrinkage hasn't derailed Bitcoin's balanced outlook. Funds leaving exchanges failed to dent its ascent, while rising mining difficulty suggests no widespread miner distress. As one commentator put it, 'The network's fundamentals are speaking louder than short-term volatility.'

US Vice President Vance Predicts 100M Bitcoin Holders in US as Adoption Accelerates

J.D. Vance, the Vice President of the United States, has positioned Bitcoin as an inevitable mainstream asset during his keynote at the Bitcoin Conference. With 50 million Americans already holding BTC, Vance projects this figure will double "before too long" as the cryptocurrency displaces traditional stores of value like gold.

The VP's bullish stance extends beyond price speculation to Bitcoin's foundational technology. He emphasized its role in pioneering decentralized finance solutions that are reshaping both domestic and international payment systems. This sentiment aligns with the current administration's pro-innovation agenda, evidenced by recent stablecoin legislation designed to enhance financial infrastructure.

Market observers note the speech's timing coincides with growing institutional interest, as regulatory clarity and technological utility converge to drive adoption. "What began as an experiment has become a genuine, ground-up innovation," Vance remarked, underscoring crypto's organic growth trajectory in American financial portfolios.

Is BTC a good investment?

Based on current technicals and market developments, BTC presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -0.09% discount | Neutral |

| MACD Histogram | +975.26 | Bullish momentum |

| Bollinger Band | Middle band test | Short-term equilibrium |

| Institutional Demand | Wall Street accumulation | Structural support |

Robert notes: 'The combination of tightening supply and growing institutional adoption suggests any dips toward $112.7k should be buying opportunities.'

BTC remains a high-conviction investment given macroeconomic adoption trends and favorable technicals.